2020-21 Katy ISD Tax Rate Decrease

At last month's Board Meeting, Trustees approved a drop in the school tax rate of 5.43 cents per $100 valuation.

"The property tax rate is decreasing 5.43 cents due to the passage of House Bill 3, which was approved during the 86th legislative session in 2019," said Chief Financial Officer Christopher J. Smith. "Our goal is to consistently provide high-quality education to our learners while being a good steward of our taxpayers' dollars. With this decrease, a residential household will see an approximate savings of $148 for the 2021 taxable year," added Smith.

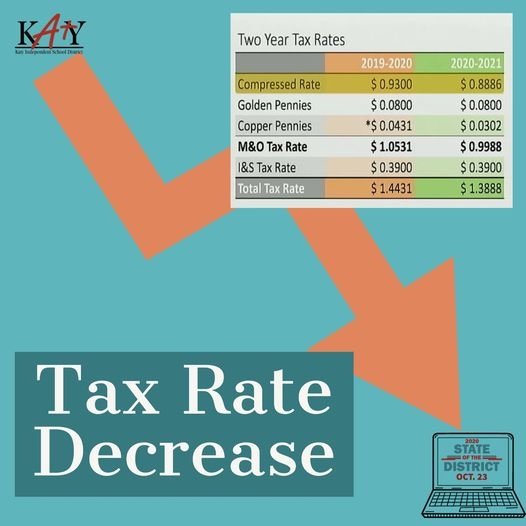

Current Tax Rate: 2019-20

Maintenance & Operations/General Operating (M&O) $1.0531

Interest & Sinking/Debt Service $0.3900

Total Tax Rate $1.4431

Proposed Tax Rate: 2020-21

Maintenance & Operations/General Operating (M&O) $0.9988

Interest & Sinking/Debt Service $0.3900

Total Tax Rate $1.3888

This will be the fourth time in the last 15 years that Katy ISD has reduced its school tax rate. Wednesday, October 21, 2020 approved tax rate will take effect immediately and will be seen on tax statements later this fall.